COVID-19 Update: Job Keeper Payment Announcement

As most of you would be aware, the Federal Government announced a further range of measures to help combat the financial effect of the COVID-19 global pandemic. The Job Keeper Payment is designed to give businesses $1,500 per fortnight to pay the wages of each eligible employee.

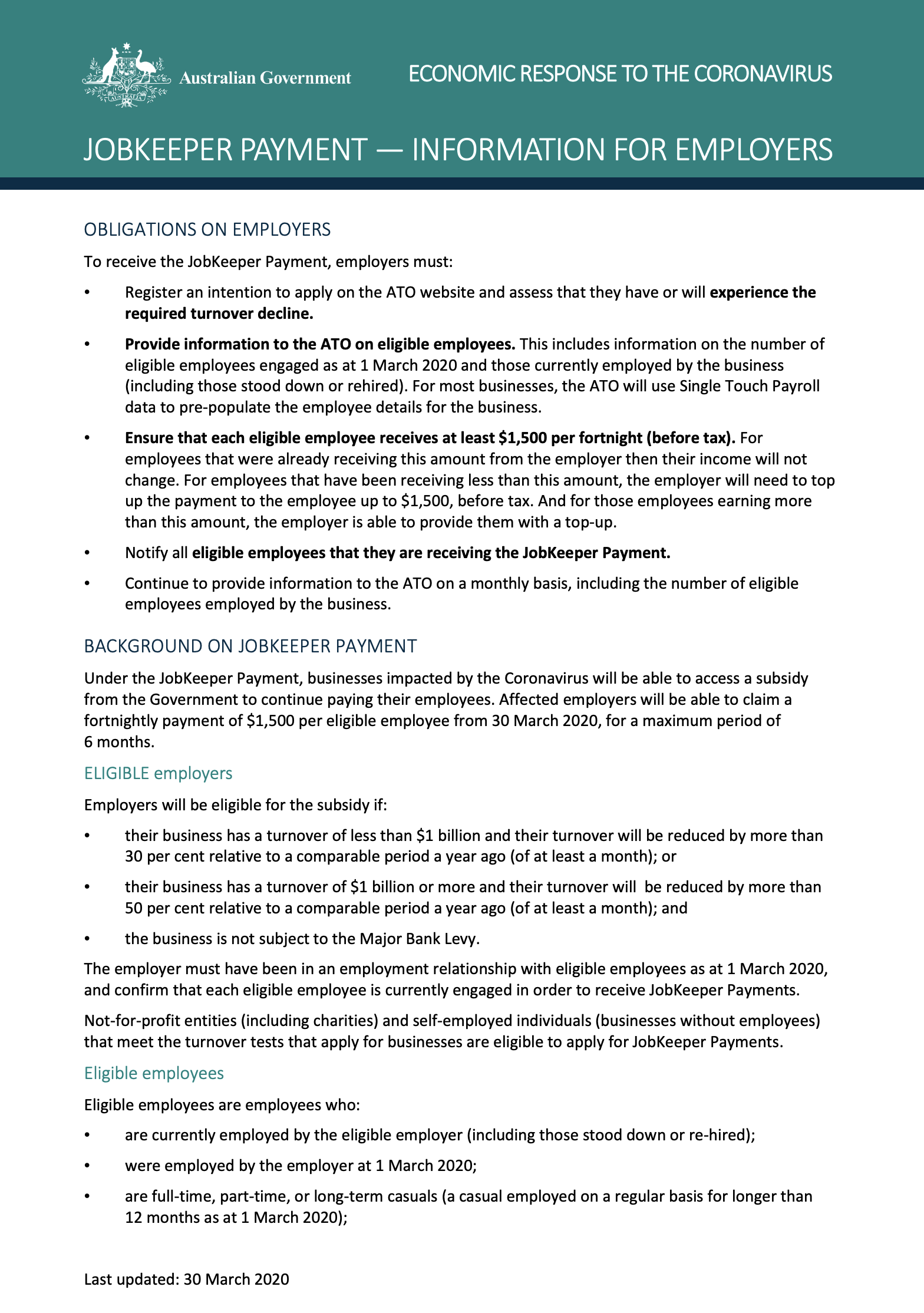

Attached below is a fact sheet giving further details of the package.

We recommend that, if you employ staff, you register for the package.

You can register your interest at

https://www.ato.gov.au/general/gen/JobKeeper-payment/?=redirected_JobKeeper

We will advise you in due course as further details are provided.

PLEASE READ THE FACT SHEET IN THE BELOW LINK:

Recent Posts

Recent Comments

- Jonathan Bill Kueh on ATO support for businesses in difficult times

- Chloe on COVID 19 Update: Job Keeper Payment Announcement

- Donna on COVID 19 Update: Job Keeper Payment Announcement

- peter jack on COVID 19 Update: Job Keeper Payment Announcement

- Matt on COVID 19 Update: Job Keeper Payment Announcement

Archives

- April 2024

- March 2024

- February 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- December 2019

- November 2019

- October 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- February 2019

10 Comments.

If the business has stood employees down and has closed. There is no money to outlay this payment while waiting for funding. Are business able to start the payments and backdate employees once the first payment of funding has gone to the employer?

If the employees have been stood down (not fired/resigned/redundancy) they are still on the payroll and leave continues to accrue.

Given the turnover will have dropped by more than 30% then the business will receive the $1,500 p/fortnight. This must be paid over to the employee Pre-tax) and no super is required to be paid on this. No further payment is required until they are no longer been stood down.

If you are intending to pay them wages, then you need to continue to report the wages (and PAYGW) and get the withholding reimbursed (up to $50,000 by June), however this will require you to pay the net wages to the employee. If the wages are less than $1,500 p/fortnight then the employee must still receive $1,500. If the wages are more than $1,500 then you are obliged to continue to pay the reported wages. In other words the employee receives the lesser of $1,500 or the reported wage every fortnight.

This doesn’t answer the question above I don’t think? If the business had to close and has no money to pay employees until the government payment comes through, can they wait for the government money and back pay their employees?

Can a restaurant reopen selling take away food make their employees work for this money.

Hi Michelle,

The idea of the job keeper payment is to keep people employed. If the restaurant reopened and sold takeaway food then you are eligible to register and claim the job keeper payment. Please note that you would need to show that your turnover has reduced by 30% and that the respective employee was on your books before closure. Also note that this has not yet been legislated and as such full details of the package have not yet been released.

My daughter is a casual for Kmart and whilst Westfarmers has openly started they are remaining open and not applying for the job keeper payment all her shifts have been cancelled due to change in opening hours and closing of fitting rooms and whilst they did have her working in other areas this week, no more shifts after today. Cause she lives at home and studies full time at Tafe she is not eligible for any other govt payments even though she pays for her own expenses.

Just wondering could the legislation change with the big companies and billion dollar turnover? They haven’t lost > 50% turnover. So we can’t get job keeper because they are still making sales in other areas. So we are disadvantaged as, being an employee to a big company.

in case of a lockdown for a non essential services company standing down its employees, can the employer force its employees to use their annual leaves whilst claiming the Jobkeeper payment from government? Or can employees request unpaid leave, earn the Jobkeeper allowance and preserve their leaves?

If your employer has applied for the job keeper payment and has reduced the number of days/hours you work, do you accrue leave at the rate for your ordinary hours usually worked or does leave accrue based on the reduced hours.

Self employed – 2018/2019 sole trader Abn

June 2019 changed to abn/acn company of the same industry-only person on company director – lodged tfn dec on xero accounting software in July 2019, made 3 payslips from Xero accounting software of small income less then taxable income.

Paid and declared to Centrelink $100 per fortnight as in come through the company. No tax has been withheld as Under tax free threshold.

Claims single parent payment; family tax and B – declares $100 per fortnight

Should be eligible for the $550 per fortnight subsidy as well as even with the $1500 per fortnight income a small amount of pension is still available.

Is the $550 taxable as well?

Can this jobkeeper payment still be available?

Is the $550 classed as a taxable income?